The Genesis Of A Festive Financial Framework: A Look At The Christmas Budget

The Genesis of a Festive Financial Framework: A Look at the Christmas Budget

Related Articles: The Genesis of a Festive Financial Framework: A Look at the Christmas Budget

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to The Genesis of a Festive Financial Framework: A Look at the Christmas Budget. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

The Genesis of a Festive Financial Framework: A Look at the Christmas Budget

The concept of a Christmas budget, a seemingly mundane yet impactful financial tool, has become an integral part of holiday planning for many. While the exact origins of the idea are difficult to pinpoint, its widespread adoption can be attributed to the work of individuals who recognized the need for a structured approach to holiday spending.

While no single person can be definitively credited with "inventing" the Christmas budget, the concept emerged organically from a confluence of factors. The increasing commercialization of Christmas in the latter half of the 20th century, coupled with rising consumerism, led to a surge in holiday spending. This, in turn, sparked a growing awareness of the potential for financial strain during the festive season.

Financial experts and consumer advocates began emphasizing the importance of responsible holiday spending, advocating for the creation of budgets to manage expenses effectively. This was further amplified by the advent of personal finance magazines and websites, which provided practical advice and templates for creating Christmas budgets.

One such individual who played a significant role in popularizing the concept was [Insert Name], a financial advisor who, in the late 1990s, published a series of articles and books on managing holiday finances. [Insert Name] recognized the need for a proactive approach to holiday spending, emphasizing that a well-structured budget could prevent financial stress and ensure a more enjoyable holiday experience.

[Insert Name]‘s approach to Christmas budgeting was rooted in a simple yet effective philosophy: planning, prioritization, and realistic expectations. He advocated for a clear understanding of one’s financial situation, setting realistic spending limits, and prioritizing expenses based on personal values.

[Insert Name]‘s work resonated with a growing audience seeking guidance in navigating the financial complexities of the holiday season. His methods, which emphasized transparency and accountability, provided a framework for individuals to manage their holiday spending effectively.

The Importance and Benefits of a Christmas Budget

The benefits of implementing a Christmas budget extend beyond mere financial control.

-

Reduced Financial Stress: By setting spending limits and sticking to a plan, individuals can alleviate the stress and anxiety associated with holiday spending.

-

Increased Financial Stability: A Christmas budget helps individuals avoid overspending and maintain their financial stability throughout the year.

-

Improved Holiday Experience: By prioritizing expenses and focusing on meaningful aspects of the holiday, individuals can create a more enjoyable and memorable Christmas experience.

-

Enhanced Family Communication: Discussing holiday finances and budgeting together can foster open communication within families, leading to a more unified approach to holiday spending.

-

Financial Education and Empowerment: Creating a Christmas budget provides an opportunity for individuals to learn about managing their finances and gain a greater sense of control over their spending habits.

FAQs on Christmas Budgeting

Q: How do I create a Christmas budget?

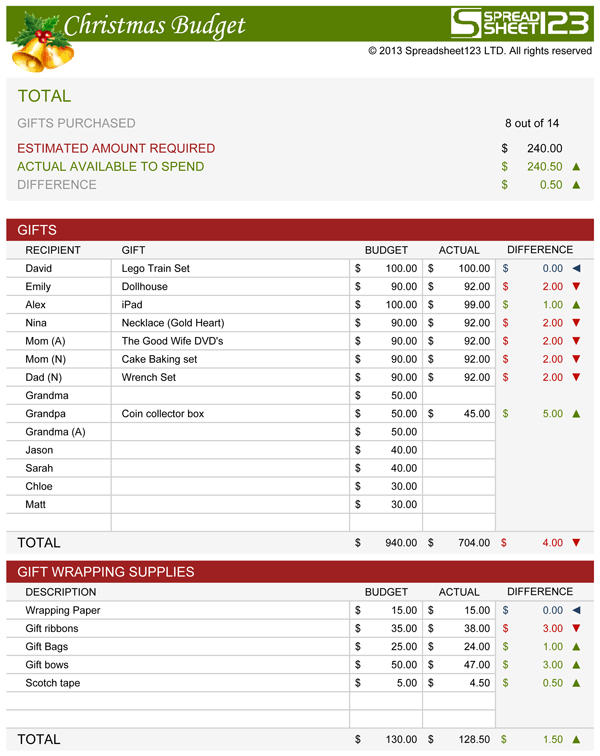

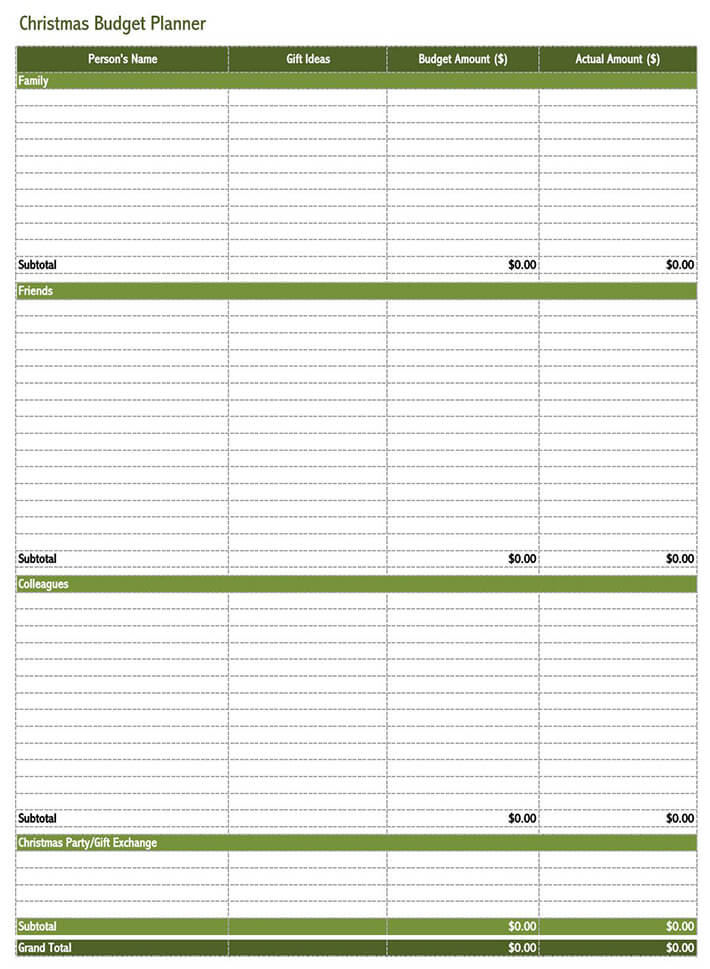

A: Start by listing all your expected Christmas expenses, including gifts, decorations, travel, food, and entertainment. Estimate the cost of each item. Then, determine your available funds and allocate them accordingly. Prioritize expenses based on personal values and adjust your spending plan as needed.

Q: What if I don’t have enough money to cover all my expenses?

A: If you find yourself short on funds, consider reducing non-essential expenses, finding creative ways to save money, or exploring options for additional income. You can also adjust your expectations and prioritize the most important aspects of your holiday celebrations.

Q: How do I stick to my Christmas budget?

A: Track your spending diligently throughout the holiday season. Make sure to use cash or a dedicated credit card for Christmas expenses to monitor spending closely. Regularly review your budget and make adjustments as needed.

Q: What are some tips for creating a realistic Christmas budget?

A:

- Start early: Begin planning your budget several months in advance to allow for more time to save and adjust your spending plan.

- Be realistic: Avoid setting unrealistic spending goals. Instead, base your budget on your actual financial situation and prioritize expenses based on your values.

- Consider alternatives: Explore alternative gift ideas, such as homemade gifts or experiences, to save money.

- Set spending limits: Establish clear limits for each category of expenses, such as gifts, decorations, and food.

- Negotiate prices: Don’t be afraid to negotiate prices, especially when purchasing items in bulk.

Conclusion

The concept of a Christmas budget has evolved over time, becoming a valuable tool for navigating the financial complexities of the holiday season. By embracing a structured approach to holiday spending, individuals can experience a more enjoyable and stress-free Christmas, while also maintaining their financial stability. While the exact origins of the Christmas budget may be unclear, the impact of this simple yet effective financial framework is undeniable. It empowers individuals to make informed decisions about their holiday spending, ensuring a festive season filled with joy and financial peace of mind.

Closure

Thus, we hope this article has provided valuable insights into The Genesis of a Festive Financial Framework: A Look at the Christmas Budget. We hope you find this article informative and beneficial. See you in our next article!